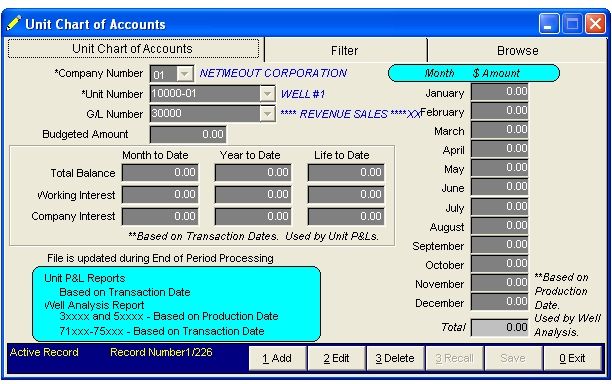

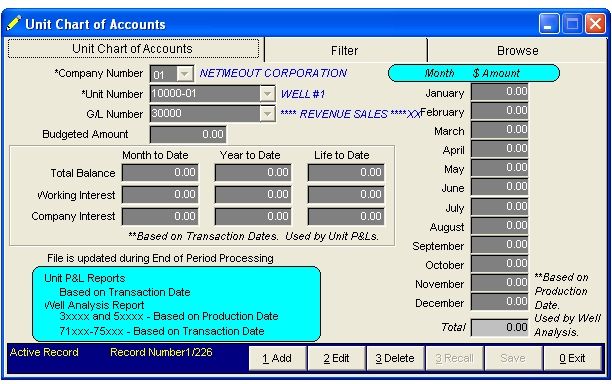

Unit Chart of Accounts

This is the Chart of Accounts file for your units. Each unit must have its own Unit Chart of Accounts to provide the Financial Reports for the Wells. Unit Chart of Accounts only has general ledger numbers 3xxxx (revenue), 5xxxx (tax/deductions) and 71xxx-75xxx (expenses).

TIME SAVER:

If you are setting up your data files for the first time, once you setup your Company Chart of Accounts, you can use the Quick Copy Tool to Copy those Accounts to your Units - (the current month and year to date balance figures are not copied).

You can also use the Quick Copy Tool to Copy from One Unit to Another Unit. After copying the accounts, you can return here and make any changes, if needed, to individual accounts.

Select Master - Unit Chart of Accounts

The Unit Chart of Accounts is updated when you close a period. Production date from the Transaction file is used to update for sales (3xxxx) and taxes (cost of sales 5xxxx) in the month of production. Transaction date is used to update expenses (71xxx to 75xxx).

Note: In order to display all records of a file, the Filter conditions must be blank, otherwise it will only list records that were contained in the previous filter.

NOTES ON FIELDS

COMPANY NUMBER: Your company number for this unit.

GENERAL LEDGER NUMBER: This general ledger number MUST exist in the Company Chart of Accounts.

BUDGETED AMOUNT: A budgeted amount, if any for each general ledger number. Usually used for drilling, completion, workover, etc… used in the Well Cost report.

MTD, YTD, LTD TOTAL BALANCE: Gross amount for each general ledger for this unit for the last period updated. Month to date balance is replaced and year to date balance and life to date balance for Unit Chart of Accounts are updated when you close a period.

MTD, YTD, LTD BALANCE WORKING INTEREST: Each transaction status for a unit will add the total from the DOI of all working interest owners values of sales, taxes and 100% W.I. expenses and update month to date values. Year to date and life to date values will be added to prior values. Use the Owners Share by Unit report to check working interest values for sales, taxes and expenses for current month. The Unit P & L report for working interest reads from this field for each unit.

MTD, YTD, LTD BALANCE COMPANY INTEREST: Each transaction status for a unit for sales, taxes and expenses will check the DOI file for the company's percent. When you close a period, the company's month to date value will be replaced and the year to date and life to date value will be added to prior values. Use the Owners Share by Unit report to check company's share of sales, taxes and expenses for current month. The Unit P & L report for company interest reads from this field for each unit.

MONTH DOLLAR AMOUNT: Production date is used for month and dollar amount values to update sales (3xxxx) and taxes (cost of sales) (5xxxx) when you close a period. Transaction date is used for month and dollar amount values to update expenses (71xxx to 75xxx). These fields are read for the Well Analysis report for dollar amounts and month. Values for production volume are read from the Unit/Well file for production month and oil volume or gas volume.

Related Topcis

Oil & Gas Business for Dummies ~ Accounting for Dummies ~ Quick Copy Tool

Roughneck Help System 02/15/07 10:30 am Copyright © 2006, Roughneck Systems Inc.